TRAIN to stall call center growth

Date:

June 19, 2018

Policy changes on the tax and incentive regime may prompt the call center industry to revise its forecasts at a time when this sector has been experiencing tempered growth.

Benedict Hernandez, president of the Contact Center Association of the Philippines (CCAP), in a press conference said while the CCAP is yet to change the 7 to 9 percent annual growth forecast made by global consulting Everest Group under its 2016-2022 roadmap for the industry, the revision would be prompted by factors not originally taken into consideration by the study such as Tax Reform for Acceleration and Inclusion (TRAIN).

Hernandez is the first to admit the call center industry will no longer see a double digit growth rate under the present scenario. The last time the industry rose by double digit rate was in 2015 when it grew 15 percent.

Hernandez said the Everest study meanwhile already considered the impact of robotics and artificial intelligence but “a lot of the factors were not in the forecast,” one of which is TRAIN which would rationalize the incentives including the value-added tax exemption on the industry.

“We want to make sure we remain competitive and the competitiveness is (influenced by) multiple factors such as access to talent, ease of doing business, the geopolitics. But it is also your cost position… and cost is influenced by your tax policy and your incentives in relation to what other countries are doing. The projections before when we did the roadmap (these were) not in the scenario,” Hernandez said.

He added CCAP might change the forecast “if something does happen that is a material event,” referring to the change in tax incentives.

CCAP is yet to release its 2017 official revenue figures but based on the Everest study, the estimate is $13 billion, just slightly above the actual $12.77 billion reported in 2016 by CCAP members.

CCAP members have long felt the impact of robotics and AI and are now shifting to medium to complex work, introducing hybrid models by combining human and machine.

CCAP projects 14 percent of the industry now is doing low-skilled jobs and a greater proportion of 51 percent are mid-skill levels, and 35 percent high-skilled.

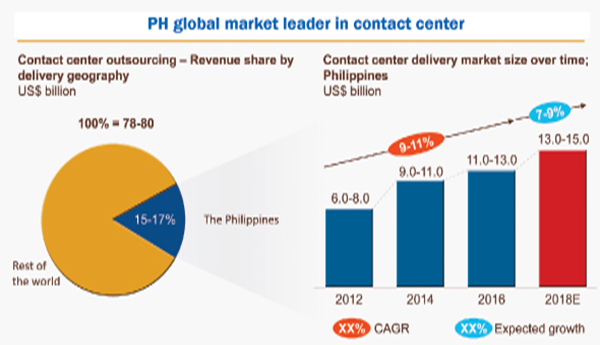

CCAP said the Philippines continues to be the biggest source of contact center services, expected to take 16 percent to 18 percent of the total outsourced services globally in 2018, based on data from The Everest Group.

The country remains ahead of its nearest competitor in this market—India. The data also indicates that the Philippine contact center sector generated $13 billion in 2017, which will continue to grow by 7 percent to 9 percent by the end of 2018.

The industry is forecasting to add another $1 billion in revenues this 2018 which translates to an additional 70,000 more jobs.

In its 2017 assessment of the industry, The Everest Group cited language skills and high empathy of the local agents coupled with competitive costs for the country’s maintained strength in its contact center value proposition. The research company added that cultural affinity to Western countries and government incentives like tax discounts and talent development programs also contribute to the local industry’s continuous growth.

The same study also emphasized that while contact center jobs are still supporting voice-related services, a rising number of tasks involve non-voice channels as well. This shift to non-voice is playing a significant role in the evolution of jobs within the industry.

A recent survey conducted by CCAP gives a quick glimpse on the ongoing shift in contact centers’ business models and evolution of agents’ jobs, as reflected in the nature of current job tasks. Of those agents who are doing voice jobs, only 14 percent are engaged in low-skill tasks. Such traditional voice-job responsibilities include telemarketing, order taking, and provision of simple customer service assistance.

Those engaged in jobs requiring middle-level skills comprises of 51 percent of the respondents. Their job tasks range from providing solutions to more complex customer problems, processing health claims, providing technical support, and business-to-business high value cross-selling/upselling.

High-level skill jobs are being done by 35 percent of the respondents. Some of the tasks they do are decision making for troubled projects and accounts, providing level 2 and 3 technical support, complex and high value claims processing requiring clinical certification, and financial analysis, among others.

Source: Malaya.com.ph